Equity Analysis using BullsEye framework

A Holistic Approach to Investment Analysis

At its core, the BullsEye Framework is an elegant synthesis of time-tested investment principles and cutting-edge analytical techniques. Like the concentric rings of a bullseye target, this framework guides investors through a series of analytical layers, each refining the investment thesis and bringing them closer to identifying truly exceptional opportunities.

1. The Outer Ring: Macro Analysis

The journey begins with a broad view of the economic landscape. This macro perspective allows investors to identify sectors poised for growth, benefiting from tailwinds that can propel companies forward. As the legendary investor Peter Lynch once said, "The person that turns over the most rocks wins the game." By starting with a macro view, investors can ensure they're looking in the right places from the outset.

In this outer ring, investors analyze factors such as:

Economic cycles and trends

Monetary and fiscal policies

Technological disruptions

Demographic shifts

Geopolitical developments

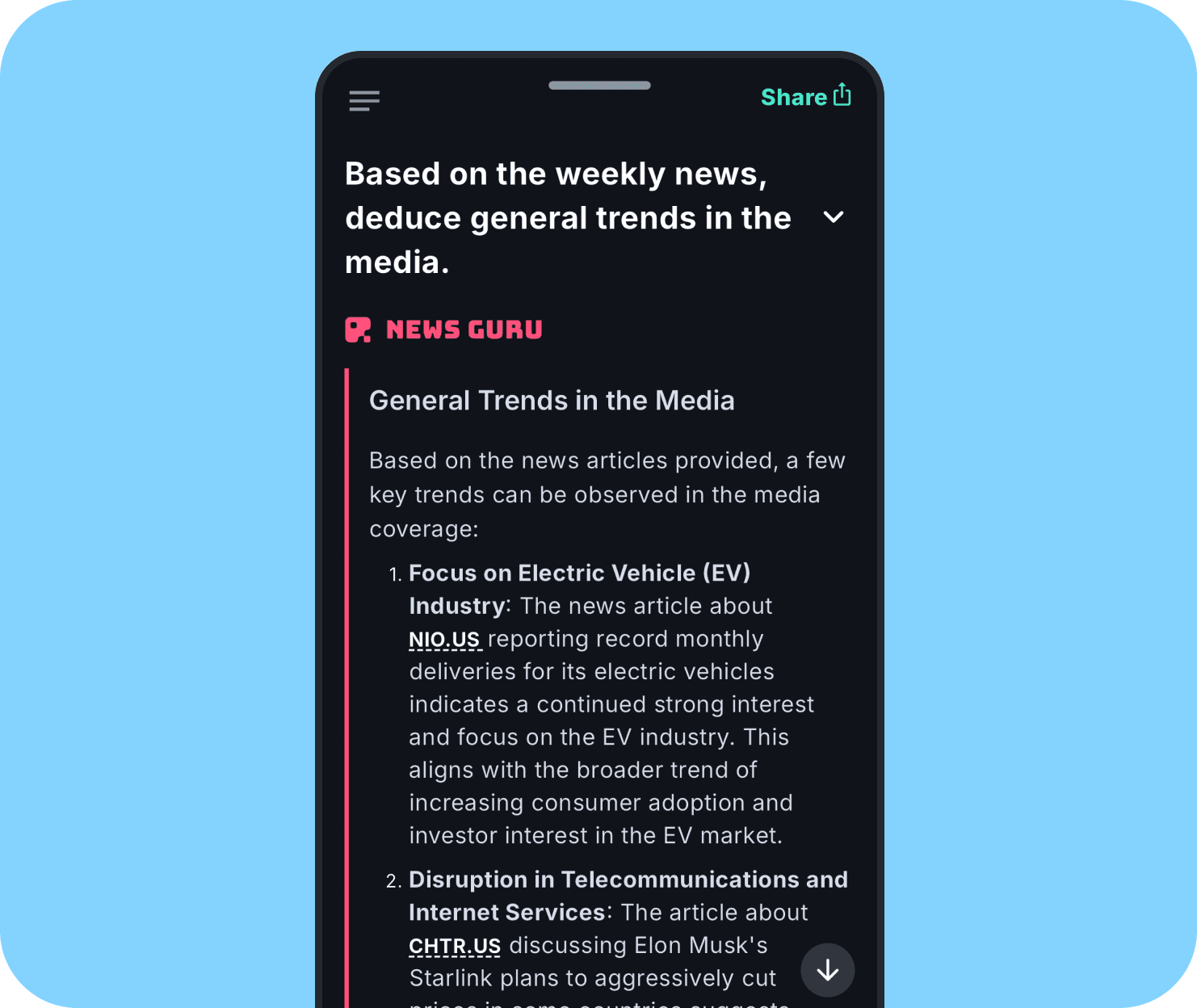

By understanding these macro forces, investors can position themselves in sectors and industries with the highest potential for sustained growth and profitability. News Guru allows you to keep track of current trends based on key events.

"Q: Based on the weekly news, deduce general trends in the media"

2. The Middle Ring: Fundamental Analysis

Once promising sectors are identified, the focus narrows to individual companies. This is where the time-honored practice of fundamental analysis comes into play. As Benjamin Graham, the father of value investing, emphasized, "The investor's chief problem—and even his worst enemy—is likely to be himself." Fundamental analysis provides a structured approach to evaluating businesses, helping investors overcome behavioral biases and make decisions based on solid financial foundations.

Key aspects of fundamental analysis in the BullsEye Framework include:

Financial statement analysis

Competitive positioning

Management quality

Growth prospects

Valuation metrics

This rigorous process helps investors filter out companies with strong business models, sustainable competitive advantages, and attractive valuations—the bedrock of successful long-term investing. RAFA AI Analyst Pro agent allows you to seamlessly perform this time consuming analysis for you

"Q: Compare the ROIC data for NVDA to its Net Income over the last 5 years, include its 5 years average, and change in percentage year over year."

3. The Inner Ring: Technical Analysis

As investors zero in on their target, technical analysis provides the final layer of refinement. While some may debate the merits of technical analysis, its inclusion in the BullsEye Framework serves a crucial purpose: optimizing entry points and managing risk.

As Jesse Livermore, one of the greatest traders of all time, noted, "The game of speculation is the most uniformly fascinating game in the world. But it is not a game for the stupid, the mentally lazy, the person of inferior emotional balance, or the get-rich-quick adventurer. They will die poor."

Technical analysis in the BullsEye Framework focuses on:

Trend identification

Support and resistance levels

Volume analysis

Momentum indicators

Chart patterns

By incorporating technical analysis, investors can improve their timing, potentially enhancing returns and reducing downside risk.

RAFA AI Quant Pro agent does exactly that for you by automating this process, you can analyze and refine entry and exit with this agent.

"Q: Give me a short term trade strategy for NVDA with entry and exit points"

Hitting the Bullseye: Generating Alpha Through Integration

The true power of the BullsEye Framework lies in its integration of these three analytical layers. By moving from the macro to the micro, and then refining with technical analysis, investors can:

Identify sectors with favorable tailwinds

Select fundamentally strong companies within those sectors

Optimize entry and exit points for maximum returns

This comprehensive approach allows investors to generate alpha across multiple time frames, from long-term strategic positions to shorter-term tactical trades.

Income Generation: An Added Dimension

An innovative aspect of the BullsEye Framework is its emphasis on income generation. Once investors have identified and acquired positions in high-quality companies, they can use advanced options strategies to generate additional income from their holdings. This approach aligns with the philosophy of legendary investor Warren Buffett, who famously said, "If you aren't thinking about owning a stock for ten years, don't even think about owning it for ten minutes."

By implementing covered call strategies or cash-secured put writing, investors can enhance their returns while maintaining their core long-term positions. This income generation component adds another layer of sophistication to the framework, allowing investors to maximize the utility of their capital.

The Role of Technology: RAFA AI and Portfolio Alerts

In today's fast-paced markets, technology plays a crucial role in successful investing. RAFA's advanced platform provides real-time portfolio alerts, enabling investors to:

Monitor their positions efficiently

Identify income generation opportunities

Manage risk dynamically

Stay informed about relevant market developments

By integrating technology into the investment process, the framework empowers investors to make data-driven decisions with unprecedented speed and accuracy.

Conclusion: A New Paradigm in Investment Analysis

The BullsEye Framework represents a paradigm shift in investment analysis, offering a structured yet flexible approach to navigating complex financial markets. By combining macro insights, fundamental analysis, and technical refinement, investors can systematically identify and capitalize on opportunities across various market conditions.

As we look to the future of investment management, frameworks like BullsEye will become increasingly important. In a world of information overload and market noise, having a clear, systematic approach to analysis is more valuable than ever. The BullsEye Framework provides just that—a roadmap for investors to cut through the chaos and consistently hit their investment targets.

By embracing this holistic approach, investors can position themselves to generate significant alpha, manage risk effectively, and build wealth over the long term. In the words of Peter Lynch, "The key to making money in stocks is not to get scared out of them."